Don’t Miss Out: Claiming Energy-Efficient Home Improvement Tax Credits in 2025

Claiming tax credits for energy-efficient home improvements in 2025 offers homeowners in the US a significant opportunity to reduce their tax burden while investing in upgrades that lower energy consumption and increase property value, contributing to both personal savings and environmental sustainability.

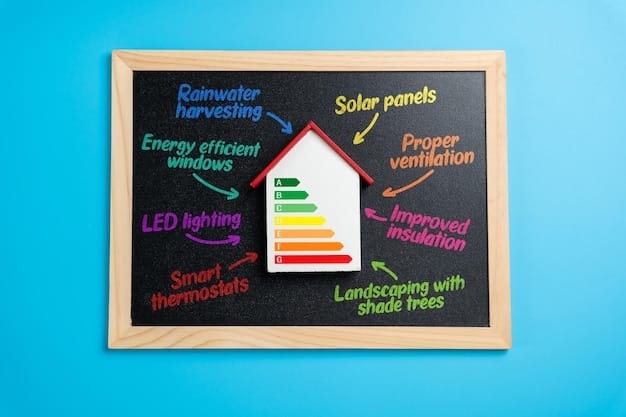

Are you planning to make your home more energy-efficient? The year 2025 brings with it opportunities to not only reduce your carbon footprint but also to save money through tax credits. Understanding the ins and outs of claiming tax credits for energy-efficient home improvements in 2025 can help you make informed decisions and maximize your savings.

Understanding Energy-Efficient Home Improvement Tax Credits

Energy-efficient home improvements not only benefit the environment but also offer financial incentives to homeowners. These incentives come in the form of tax credits, which directly reduce the amount of tax you owe. Let’s delve into the basics of these credits and how they can benefit you in 2025.

What are Energy-Efficient Home Improvement Tax Credits?

Energy-efficient home improvement tax credits are government incentives designed to encourage homeowners to invest in upgrades that reduce energy consumption. These credits can cover a percentage of the costs associated with purchasing and installing qualified energy-efficient equipment.

Why are these Credits Important?

These credits are crucial because they promote sustainable living and reduce the overall demand for energy. By incentivizing homeowners to make energy-efficient upgrades, the government can help lower carbon emissions and promote a greener future.

- Reduces Tax Burden: Tax credits directly lower the amount you owe in taxes.

- Promotes Sustainability: Encourages the use of energy-efficient technologies.

- Increases Home Value: Energy-efficient upgrades can boost your property’s value.

- Lowers Energy Bills: Reduces your monthly expenses by lowering energy consumption.

In summary, understanding energy-efficient home improvement tax credits is the first step toward making smart, sustainable choices for your home. These credits offer a win-win situation, benefiting both your wallet and the environment.

Key Tax Credits Available in 2025

In 2025, several tax credits are available for homeowners looking to upgrade their homes with energy-efficient improvements. Knowing which credits you can claim can significantly impact your budget and project planning. Here are some of the most important tax credits to consider.

The Energy Efficiency Home Improvement Credit

This credit, also known as the 25C tax credit, covers 30% of qualified expenses, including the cost of qualified energy efficiency improvements and home energy audits. It offers a maximum annual credit of $1,200 for most improvements but has specific limits for certain types of equipment.

The Residential Clean Energy Credit

Also known as the 25D tax credit, this credit applies to renewable energy systems, such as solar panels, solar water heaters, and geothermal heat pumps. It offers a credit equal to 30% of the cost of new, qualified clean energy property.

The key tax credits available in 2025 provide substantial incentives for homeowners to invest in energy-efficient and renewable energy upgrades.

Navigating the Energy Efficiency Home Improvement (25C) Tax Credit

The Energy Efficiency Home Improvement Credit, or 25C tax credit, is a popular option for homeowners making smaller energy-efficient upgrades. This credit covers a range of improvements, from insulation to energy-efficient doors and windows. Let’s explore how to navigate this credit effectively.

Eligible Home Improvements

To qualify for the 25C tax credit, your improvements must meet certain standards. This typically includes meeting or exceeding Energy Star requirements. Common eligible improvements include:

- Insulation: Upgrading your home’s insulation can significantly reduce energy loss.

- Energy-Efficient Doors and Windows: Installing certified energy-efficient doors and windows helps maintain a consistent indoor temperature.

- Energy-Efficient Water Heaters: Switching to a more efficient water heater can save energy and reduce utility bills.

Maximum Credit Amounts

While the 25C tax credit covers 30% of qualified expenses, it’s important to note that there are maximum annual credit limits. The overall annual limit is $1,200, but specific limits apply to certain types of equipment:

- $600 for qualified energy property, such as a new furnace or air conditioner.

- $150 for a home energy audit.

- $250 for each new exterior door (up to a total of $500).

- $200 for each new window.

Understanding the eligibility requirements and maximum credit amounts for the 25C tax credit is essential for maximizing your savings. Make sure to keep detailed records of your expenses and consult with a tax professional to ensure you meet all the necessary criteria.

Understanding the Residential Clean Energy (25D) Tax Credit

For homeowners interested in renewable energy systems, the Residential Clean Energy Credit, or 25D tax credit, is a significant opportunity. This credit covers a substantial portion of the costs associated with installing renewable energy systems in your home. Let’s dive into the details of this credit.

Eligible Renewable Energy Systems

The 25D tax credit applies to a variety of renewable energy systems. Some of the most common eligible systems include:

- Solar Panels: Generating electricity from sunlight is a popular and effective way to reduce your carbon footprint.

- Solar Water Heaters: Using solar energy to heat your water can significantly lower your water heating costs.

- Geothermal Heat Pumps: Harnessing the Earth’s natural heat to heat and cool your home is an efficient and sustainable option.

Credit Amount and Duration

The 25D tax credit offers a credit equal to 30% of the cost of new, qualified clean energy property. Unlike the 25C credit, there are no annual limits or lifetime limits. This 30% credit is available through 2032, making it a long-term incentive for homeowners.

The Residential Clean Energy Credit is a powerful incentive for homeowners looking to invest in renewable energy systems. By understanding the eligible systems and the credit amount, you can make informed decisions and take advantage of this valuable tax benefit.

How to Claim Your Energy-Efficient Home Improvement Tax Credits

Claiming your energy-efficient home improvement tax credits involves a few key steps. Proper documentation and a solid understanding of the IRS guidelines are crucial for a smooth process. Here’s a step-by-step guide to help you claim your credits effectively.

Gather Necessary Documentation

The first step in claiming your tax credits is to gather all necessary documentation. This includes:

- Receipts: Keep detailed receipts for all qualified purchases and installations.

- Manufacturer Certifications: Obtain certifications from manufacturers stating that the products meet energy efficiency standards.

- Installer Information: If you hired a contractor, keep their contact information and any relevant certifications.

Complete the Required IRS Forms

To claim your tax credits, you’ll need to complete the appropriate IRS forms. For the 25C tax credit (Energy Efficiency Home Improvement Credit), you’ll typically use Form 5695, Residential Energy Credits. For the 25D tax credit (Residential Clean Energy Credit), you’ll also use Form 5695.

File Your Tax Return

Once you have gathered all the necessary documentation and completed the required forms, you can file your tax return. Make sure to attach Form 5695 to your return and keep copies of all documentation for your records.

Claiming your energy-efficient home improvement tax credits requires careful planning and attention to detail. By following these steps and consulting with a tax professional, you can ensure a smooth and successful process.

Maximizing Your Tax Credit Savings

To make the most of the energy-efficient home improvement tax credits, it’s essential to implement some smart strategies. These strategies can help you optimize your investments and ensure you receive the maximum possible credit. Here are some tips for maximizing your tax credit savings.

Plan Your Improvements Strategically

Before making any improvements, take the time to plan strategically. Consider conducting a home energy audit to identify the areas where you can make the most significant impact with your upgrades. Prioritize improvements that offer the highest energy savings and qualify for the largest tax credits.

Combine Credits for Greater Savings

In some cases, you may be able to combine multiple tax credits for even greater savings. For example, if you install solar panels and also upgrade your insulation, you could potentially claim both the 25C and 25D tax credits.

Keep Up-to-Date with Tax Laws

Tax laws and regulations can change over time, so it’s important to stay informed about the latest updates. Regularly check the IRS website or consult with a tax professional to ensure you’re taking advantage of all available credits and deductions.

Maximizing your tax credit savings involves careful planning, strategic investments, and staying informed about current tax laws. By following these tips, you can make the most of the available incentives and reduce your tax burden.

| Key Point | Brief Description |

|---|---|

| 💰 Tax Credits | Reduces your tax burden by directly lowering the amount you owe. |

| 🏠 Home Value | Increases your property’s value with energy-efficient upgrades. |

| ⚡ Energy Savings | Reduces monthly expenses by lowering energy consumption. |

| ☀️ Renewable Energy | Supports sustainable living and reduces carbon footprint. |

Frequently Asked Questions

▼

The primary tax credits are the Energy Efficiency Home Improvement Credit (25C) and the Residential Clean Energy Credit (25D). The 25C credit covers upgrades like insulation and energy-efficient windows, while the 25D credit applies to renewable energy systems like solar panels.

▼

To claim the credits, you’ll need detailed receipts for all qualified purchases and installations, manufacturer certifications stating that the products meet energy efficiency standards, and, if applicable, installer information and certifications.

▼

Yes, the 25C credit has maximum annual limits. The overall annual limit is $1,200, but specific limits apply to certain types of equipment, such as $600 for qualified energy property and $200 for each new window.

▼

The 25D credit applies to renewable energy systems like solar panels and geothermal heat pumps. It offers a credit equal to 30% of the cost, with no annual or lifetime limits. It’s available through 2032, offering a long-term incentive.

▼

Yes, in some cases, you may be able to combine both credits. For example, if you install solar panels (25D) and also upgrade your insulation (25C), you could potentially claim both credits simultaneously.

Conclusion

Claiming tax credits for energy-efficient home improvements in 2025 presents a valuable opportunity for homeowners to reduce their tax burden while investing in upgrades that offer lasting benefits. By understanding the available credits, gathering the necessary documentation, and planning your improvements strategically, you can maximize your savings and contribute to a more sustainable future.